Investing Theory

Maximize Gains: The 5 Must-Have Video Game Stocks for Your Portfolio in 2024

Searching for substantial picks in the gaming market for the year ahead? Look no further. This article hones in on the 5 must have video game stocks for your portfolio in 2024, pinpointing the standouts in a sector known for rapid growth and innovation.

With these video game industry insights, sharpen your investment focus and be well-armed to make decisions that could redefine your portfolio’s performance.

The Evolution of Video Game Stocks

Over the years, the video game industry has remarkably evolved. From the earliest consoles to today’s immersive virtual realities, the video game universe has expanded into a multi-billion dollar industry that continues to grow. This growth trajectory is fueled by the industry’s ability to captivate audiences worldwide with its diverse experiences and innovative technologies, making gaming stocks an attractive option for investors.

Key players in the gaming industry include:

- Developers, who create the games

- Publishers, who distribute and market the games

- Hardware manufacturers, who produce gaming consoles and accessories

- Retailers, who sell the games and gaming equipment

The gaming stock market has evolved into a sector brimming with potential for growth, making it an ideal time to explore gaming stocks to buy, with some of the stocks mentioned offering promising returns.

Mobile Gaming's Meteoric Rise

Mobile gaming has soared to meteoric heights, propelled by the revolutionary advent of smartphones. Smartphones have democratized gaming, making it more accessible than traditional gaming consoles or PCs. This accessibility is a significant driver of industry growth, with mobile games playing an instrumental role.

Glu Mobile, a company specializing in creating and releasing free-to-play games for smartphones and tablets, is a prime example of a company thriving in the mobile gaming stock boom. With a trailing 12-month revenue of approximately USD$540.5 million, Glu Mobile has staked its claim as a leader in the mobile phones gaming market, making it one of the best gaming stocks to consider for investment.

Virtual Reality and Augmented Reality: The New Frontiers

Virtual Reality (VR) and Augmented Reality (AR) technologies are leading the constant evolution of the gaming landscape. The projected growth of the VR market is a testament to the transformative power of these technologies, which are reshaping the gaming industry by delivering immersive and captivating experiences.

Companies like Magic Leap, Apple Inc., and Google LLC are leading the charge in VR and AR gaming technology. Popular VR games such as Beat Saber and Pavlov VR showcase the potential of these technologies, promising substantial investment opportunities.

The Power Players of the Gaming Sector

In the gaming universe, giants leading the way in 2024, also known as top video game companies, are:

- Microsoft

- Electronic Arts

- Take-Two Interactive

- Nintendo

- Sony

These power players demonstrate promising potential for growth, making them worthy considerations for any gaming-centric portfolio. Let's take a closer look at these interesting top gaming stocks to buy.

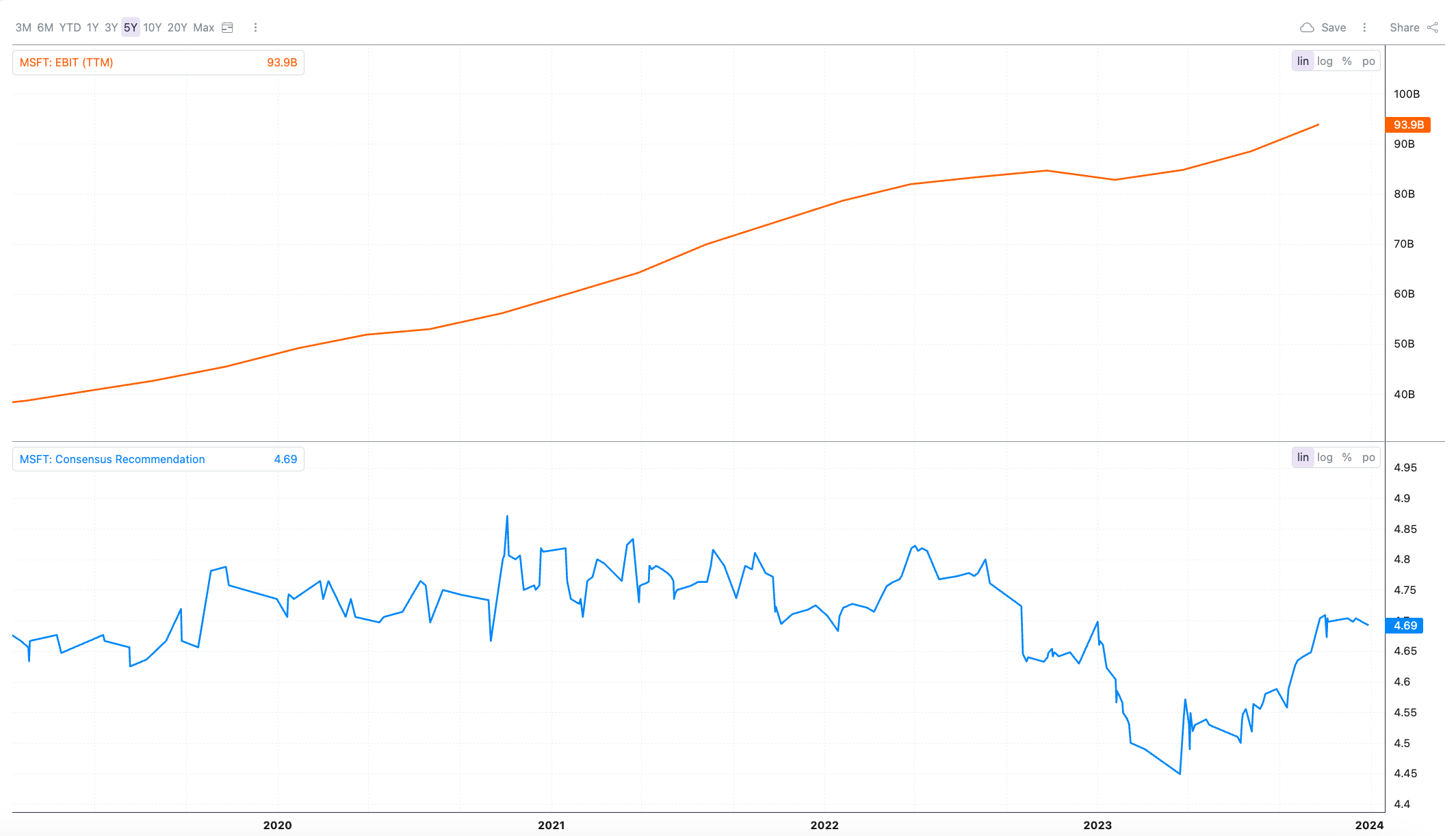

Microsoft's Market Maneuvers (NASDAQ: MSFT)

Capitalizing on strategic acquisitions and cutting-edge technology, Microsoft has established itself as a formidable player in the gaming market. Its acquisitions of Mojang, Bethesda, and the impending acquisition of Activision Blizzard have bolstered its portfolio, with iconic franchises like Call of Duty and Candy Crush adding to its repertoire.

Moreover, Microsoft’s commitment to cloud gaming has significantly contributed to its revenue in the gaming sector, amounting to $4 billion annually. Furthermore, its $10 billion investment in AI, specifically in ChatGPT, underscores the company’s commitment to advancing the gaming experience.

Electronic Arts' Enduring Appeal (NASDAQ: EA)

With its diverse range of games, Electronic Arts has carved a niche in the video game industry. From sports to first-person shooters, its portfolio includes a broad spectrum of genres. Its notable franchises such as Battlefield, The Sims, and Apex Legends contribute significantly to its appeal.

The company has also marked its territory in the mobile gaming sector with the acquisition of Glu Mobile in June 2021. This strategic move signals its intention to tap into the rapidly growing mobile gaming market.

Take-Two Interactive Software 's Triumphs (NASDAQ: TTWO)

With successful franchises like Grand Theft Auto and NBA 2K, Take-Two Interactive has made a name for itself in the gaming industry. They are a real market giant - one of their subsidiaries is, for example, the famous Rockstar Games or Zynga. The company’s impressive financial track record, coupled with its promising growth prospects, make it a compelling choice for investors.

Looking at its valuation against market norms, Take-Two Interactive’s robust financial history and competitive valuation make it a promising investment. With projected revenue of $8 billion and a potential earnings of around $2 billion, it stands as a high-caliber company with robust growth prospects.

Nintendo: Innovating Interactive Entertainment (TYO: 7974)

By providing unique and engaging experiences for gamers worldwide, Nintendo’s innovative approach has revolutionized the gaming industry. From the NES’ directional pad to the interactive Labo kits or famous Nintendo Switch, Nintendo’s products reflect a dedication to innovation and user experience.

The company’s strength lies in its robust brand identity and a dedicated consumer base. Prominent franchises such as Mario, The Legend of Zelda, and Pokémon have played a significant role in bolstering Nintendo’s success, solidifying its position as a key player in the interactive entertainment industry.

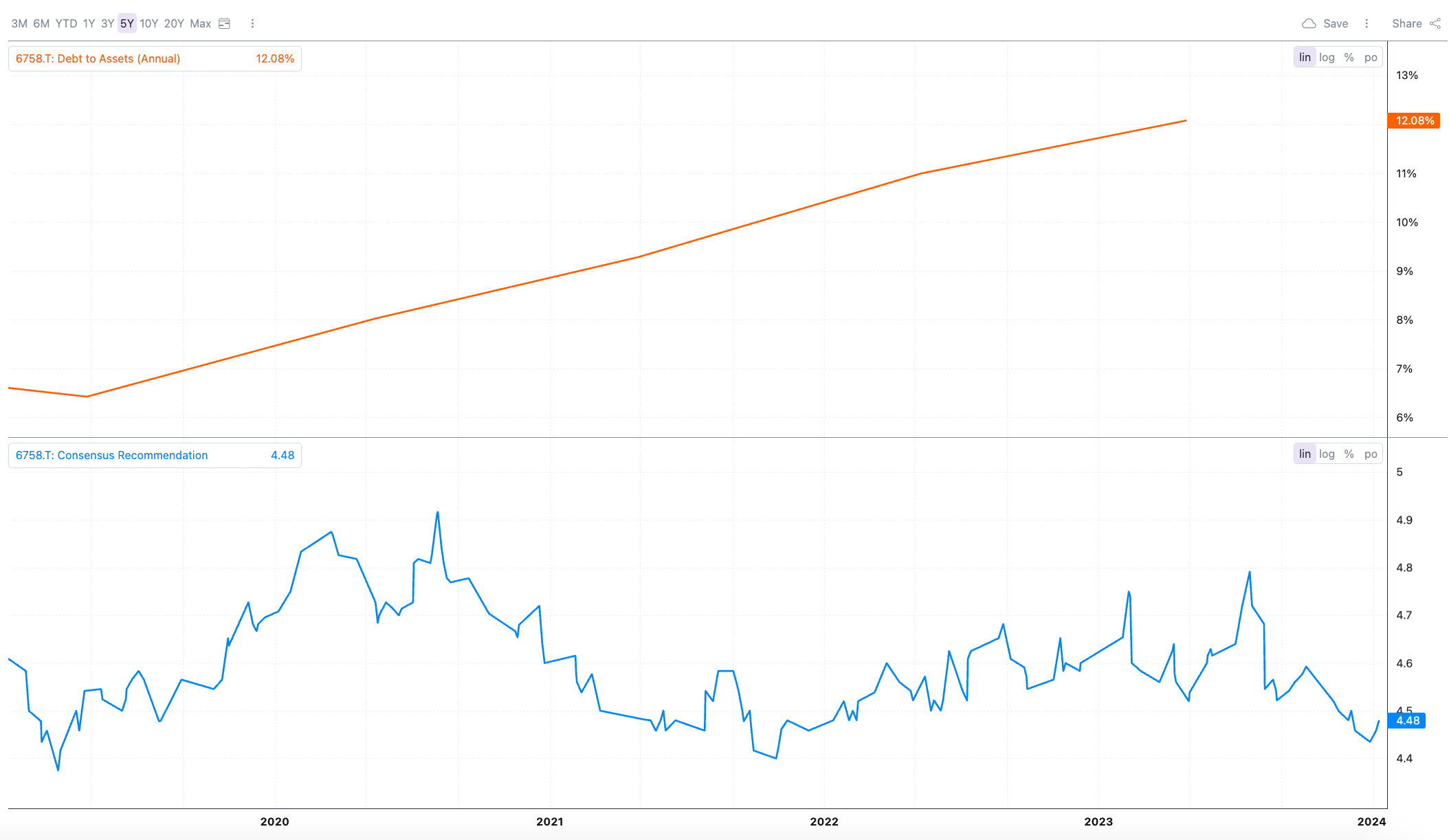

Sony's Strategic Successes (TYO: 6758)

Leveraging its exclusive titles and robust ecosystem, Sony has carved a prominent niche in the gaming industry. The company’s successful franchises, including Gran Turismo, God of War, and Spider-Man, contribute significantly to its standing in the market.

Sony’s Playstation Network plays a crucial role in the company’s profitability, contributing to approximately one-third of its income. The network’s success is a testament to Sony’s dominance in the gaming industry and its appeal to both gamers and investors alike.

The Risks and Rewards of Investing in Gaming Stocks

Challenges are inherent in investing in gaming stocks. It’s important for investors to consider the fluctuating conditions in both the market and the video game industry before making any investments.

The gaming industry is characterized by market saturation, evolving consumer preferences, and technological advancements. These factors represent diverse risks and challenges that investors need to be cognizant of to ensure their investments yield the desired returns.

Building a Balanced Gaming Portfolio

The art of building a balanced gaming portfolio necessitates strategic diversification across various segments and companies in the gaming industry. Investors can leverage established gaming companies, emerging players, and related sectors such as esports and gaming accessories to diversify their investments.

A balanced video game portfolio offers increased visibility in the market, improves chances of overall success by mitigating risks, and enhances the potential to maximize earnings from gaming industry investments.

Summary

A plethora of investment opportunities are presented by the video gaming industry. With a keen understanding of the market trends, a balanced gaming portfolio, and a strategic approach, investors can maximize their gains from gaming stocks and thrive in the dynamic world of gaming investments.

As we conclude this engaging journey through the gaming stocks to buy, it’s clear that industry offer a wealth of opportunities for investors. By capitalizing on the growth of the industry, understanding the risks and rewards, and building a balanced portfolio, investors can harness the potential of gaming stocks and achieve substantial returns.

And let's be honest: new games come out every year. Fans of items such as Grand Theft Auto, God of War and Fifa eagerly await the next releases of their favorite games. And even if a brand makes you wait a really long time for a new release - fans don't complain. The most famous such action was probably the famous "beeep" written on the Tweeter profile of the game Cyberpunk 2077.

Interestingly, the above tweet was... catalyzed the actions of stock market investors. According to Business Insider, it was reflected in the price of CD Projekt, which rose by more than 4 percent from this morning until 1:45 p.m. The price of the stock rose from PLN 99 to PLN 103.

So you can see for yourself that stock prices in the gaming industry are changing extremely dynamically - just as the whole industry is developing.

Pssst... if you are curious about what other industries' stocks beyond gaming stocks are worth betting on in 2024 - be sure to read our text titled "A Glimpse into the Future: Best Stocks for 2024 Investments".

Start your free trial

Similar posts

Start your 7-day free trial