Basics

Understanding the Differences: ETFs vs Mutual Funds - Choosing the Right Investment for You

Investors often grapple with the decision of choosing between ETFs and mutual funds. Understanding the differences between ETFs vs mutual funds can equip you with the knowledge to personalize your investing strategy.

Let's read the post, which delves into the nuances between ETFs and mutual funds, highlighting how mutual funds are actively managed by a fund manager from a specific fund company, whereas ETFs often passively track an index. Explore the tax-efficient nature of ETF compared to mutual fund, offering readers insights into choosing between these investment vehicles based on their investment goals and preferences.

Exploring the Difference Between ETF and Mutual Fund

Both mutual funds and ETFs are collective investment vehicles that provide investors with access to various asset classes, allowing for diversification of their portfolio. They are professionally managed portfolios consisting of individual securities and offer a range of investment objectives. They have distinct characteristics that could influence an investor’s choice.

ETFs are recognized for being cost-effective, tax-efficient, and providing extensive market coverage compared to index mutual funds. This makes them a popular choice among investors seeking broad market exposure. On the other hand, mutual funds offer benefits such as professional management services, automatic diversification across different asset classes, and the convenience of setting up automated investments or withdrawals.

The decision between investing in ETFs or mutual funds heavily relies on factors unique to each investor’s situation which must be carefully considered before making any decisions regarding these pooled investment options.

The Basics of ETFs

Exchange Traded Funds (ETFs) pool funds from investors to purchase a diverse portfolio of stocks, bonds, and other securities. These ETFs are traded on stock exchanges like individual stocks, allowing for real-time pricing and flexibility in trading. This feature makes exchange traded funds an appealing choice for investors when compared to most mutual funds.

The creation process of ETFs involves buying all the underlying assets that make up the fund’s structure managed by skilled managers. The unique method of creating or redeeming shares helps maintain close alignment between ETF prices and their net asset value.

Mutual Fund: the Basics

Mutual funds are a type of investment vehicle that pools money from multiple investors to purchase a diverse range of assets. Unlike ETFs, even actively managed funds can only be traded once per day and their value is determined by the net asset value (NAV) at the end of trading.

This difference in trading mechanisms has important tax implications for investors. When redeeming mutual fund shares, the fund may have to sell off appreciated securities, which could result in capital gains distributions and potential tax consequences. While they offer an easy way to achieve diversification within one’s portfolio, it is essential for investors to consider these possible taxes associated with owning mutual funds.

Key Differences Between ETF and Mutual Fund

After covering the fundamentals of ETFs and mutual funds, it is important to explore their main distinctions. These dissimilarities are crucial for investors to grasp as they can greatly impact both the profits and tax implications of their investments.

Although both ETFs and mutual funds offer diversity and access to a broad range of asset classes, they vary in multiple aspects such as pricing mechanisms, trading methods, tax consequences, and minimum investment requirements. Understanding these discrepancies is essential when deciding which type of investment best fits your objectives and risk tolerance level.

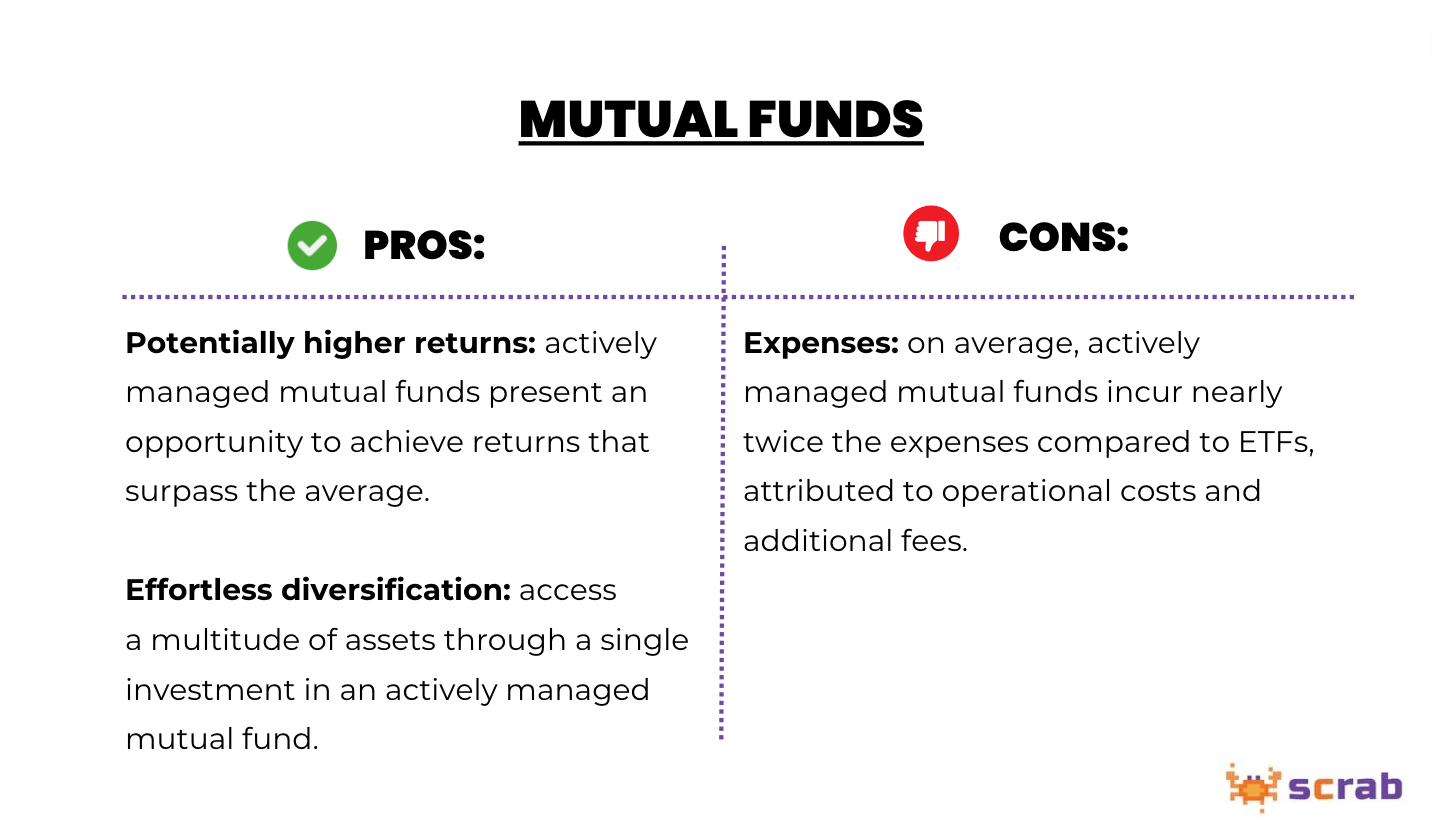

In the table below you will find arguments for betting on a mutual fund (and further down in the text - arguments for ETFs):

Pricing and Trading

A significant contrast between mutual funds and ETFs lies in their pricing and trading mechanisms. Unlike mutual funds, which are priced based on NAV at the end of a single daily trading session, ETFs can be bought or sold continuously throughout the day like individual stocks. As a result, investors have real-time access to current prices for ETF trades.

ETFs’ continuous intra-day trading feature makes them attractive options for active traders seeking flexibility in their investment decisions. On the other hand, those who do not require frequent buying and selling may find mutual funds more suitable as they are only valued once per day using net asset value (NAV). In this way, the ability to trade actively is one key distinction between ETFs and mutual funds while NAV-based valuation sets them apart from other types of investments.

Tax Implications

There is a significant difference between ETFs and mutual funds when it comes to their tax implications. ETFs are more tax efficient in taxable accounts, resulting in lower taxes compared to traditional mutual funds.

The unique creation/redemption process of ETFs through the transfer of securities rather than cash leads to decreased capital gains taxes and distributions for investors. On the other hand, buying or selling shares in mutual funds may result in generating taxable capital gains for investors. This highlights how ETFs can offer higher levels of tax efficiency compared to traditional mutual fund investments.

Note: The topic of tax implications is only sine qua non - we will not elaborate on it in this text more in view of the fact that tax issues vary significantly from country to country.

Investment Minimums and Fractional Shares

ETFs and mutual funds have different approaches to investment minimums. Unlike mutual funds, ETFs do not require a specific initial amount, making them more accessible for a wider range of investors. Even purchasing just one share of an ETF is possible, making it easier to enter the market.

On the other hand, investing in mutual funds typically requires a higher initial amount, which may pose challenges for some individuals. Fractional shares offered by these funds allow investors to invest precise amounts regardless of the share price. This feature makes investing in fund companies feasible even with limited resources.

Management Styles: Active vs. Passive

One key distinction between ETFs and mutual funds is the approach taken in their management. Typically, mutual fund managers actively make decisions on which assets to buy or sell with the goal of outperforming the market. In contrast, ETFs are passively managed and follow a predetermined index, resulting in lower expenses and improved tax efficiency.

This is by far the most common situation, although we must admit with our hands on our hearts that rarely, but nevertheless, there are ETFs actively managed at someone's discretion.

Mutual funds rely heavily on active decision-making by skilled professionals while tracking indices forms the basis for passive management of most ETFs. The latter often translates into reduced costs as well as greater effectiveness when it comes to taxes compared to actively managed funds overseen by highly-paid experts seeking superior returns through astute asset selection strategies.

Active Management in Mutual Funds

Actively managed mutual funds refer to investment options where a fund manager or team makes decisions regarding buying, holding and selling securities with the aim of achieving above market returns. This involves conducting thorough research and analysis in order to identify potential opportunities for higher profitability.

While actively managed funds offer the advantage of potentially surpassing market returns through leveraging on inefficiencies, they also come at a cost. The involvement of professional managers incurs higher expense ratios which are ultimately borne by investors.

There may be tax implications associated with these types of mutual funds that should be taken into consideration when making investment decisions.

Passive Management in ETFs

ETFs typically utilize an index fund strategy in their passive management approach. There is also the option of actively managed ETFs which follow a pre-selected index or sector. This often results in reduced costs and improved tax efficiency.

In order to track a specific index, ETFs employ various methods such as full replication, sampling, or optimization techniques. The lower expenses associated with passively managed ETFs make them a popular choice among investors and their structure contributes to minimizing capital gains distributions for enhanced tax efficiency purposes.

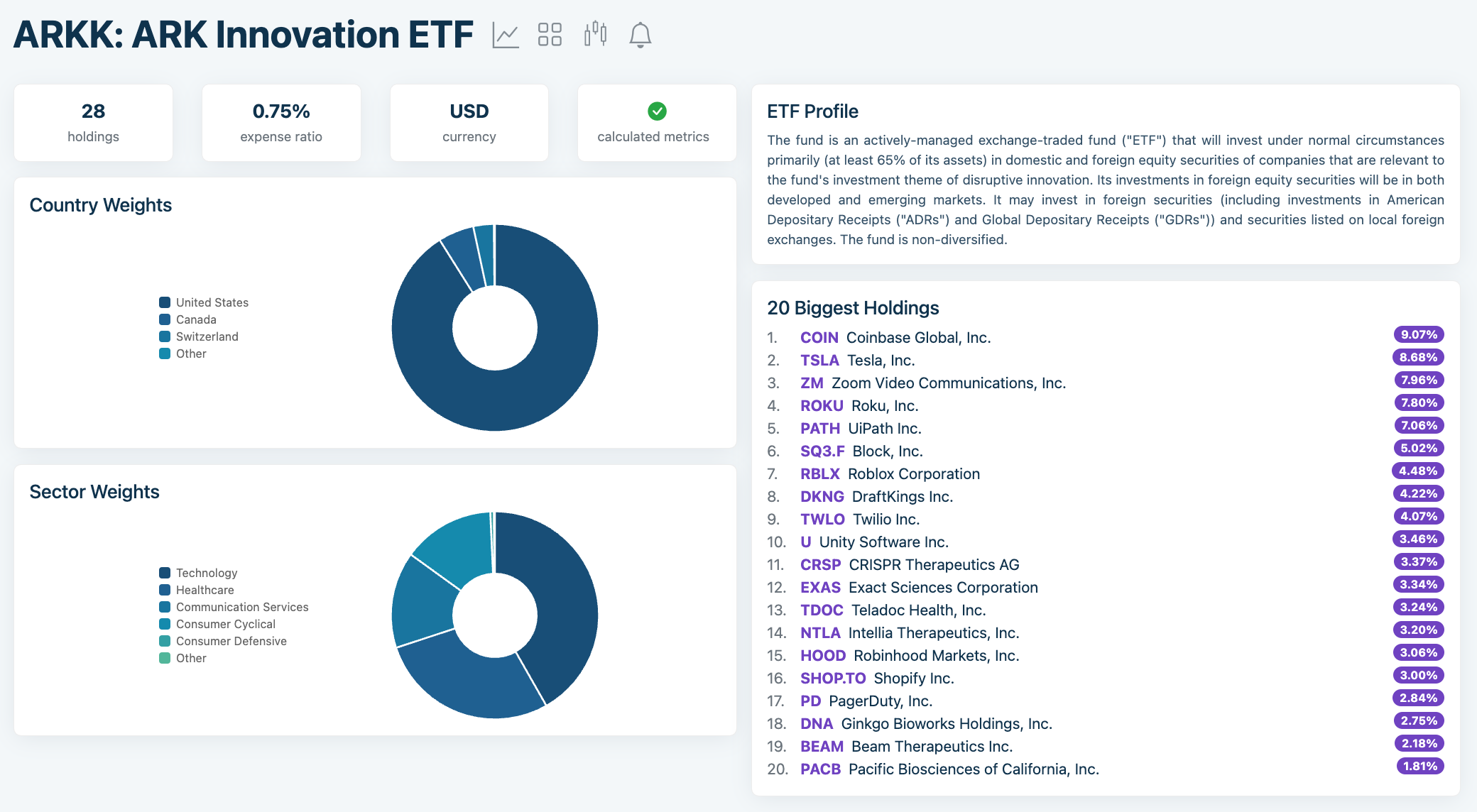

It is worth noting, however, that lately, as we already mentioned in the paragraph above, a peculiar trend has been the emergence of more and more actively managed ETFs, such as the much-publicized ARKK during the Covid:

Pssst... For a while now, Scrab.com has integrated functionality for managing your ETFs! Traditionally, investors choose ETFs based on their expense ratio and whether they offer distributed or accumulated dividends. Scrab elevates your ETF analysis by providing comprehensive insights into all the underlying companies.

It not only showcases diversification across countries and sectors and highlights key holdings but also presents fundamental metrics extracted from the companies within the ETF.

This functionality allows swift comparisons between ETFs covering identical countries or industries. You can promptly discern which ETF includes companies with the most elevated average margins, minimal debt, or swiftest revenue growth.

These metrics are automatically computed at the ETF level, removing the necessity to individually evaluate dozens or hundreds of companies within it.

Costs and Fees: Comparing Expense Ratios

One key difference between ETFs and mutual funds is their costs and fees. This includes the expense ratio, which measures the operating expenses for a given investment company’s mutual fund or ETF.

It is important to compare how expense ratios vary for both types of investments, ETFs and mutual funds. The expense ratio reflects the cost of managing these assets in relation to the overall value of each investment option.

Expense Ratios in ETFs

The expense ratios of ETFs are typically lower because they follow a passive management approach. On average, the expense ratio for ETFs is around 0.12%, which can be attributed to factors such as no sales loads or marketing fees, minimal cash drag, and limited style drift.

While there may be variations in sector-specific expenses, most have an expense ratio below 1%. Small these differences may seem at first glance, but they can significantly impact your returns over time.

As a curiosity, we can tell you that the most popular ETF in the world, the SPY (an ETF on the S&P 500 index), has a ratio of less than 0.1% - which is almost imperceptible.

Expense Ratios in Mutual Funds

Conversely, mutual funds, specifically those that are actively managed, have higher expense ratios of approximately 0.60%. This is due to the extensive research and analysis involved in active management.

Despite these greater costs, mutual funds provide advantages such as expert supervision and automatic diversification. Investors must weigh these benefits against the added expenses and potential tax implications.

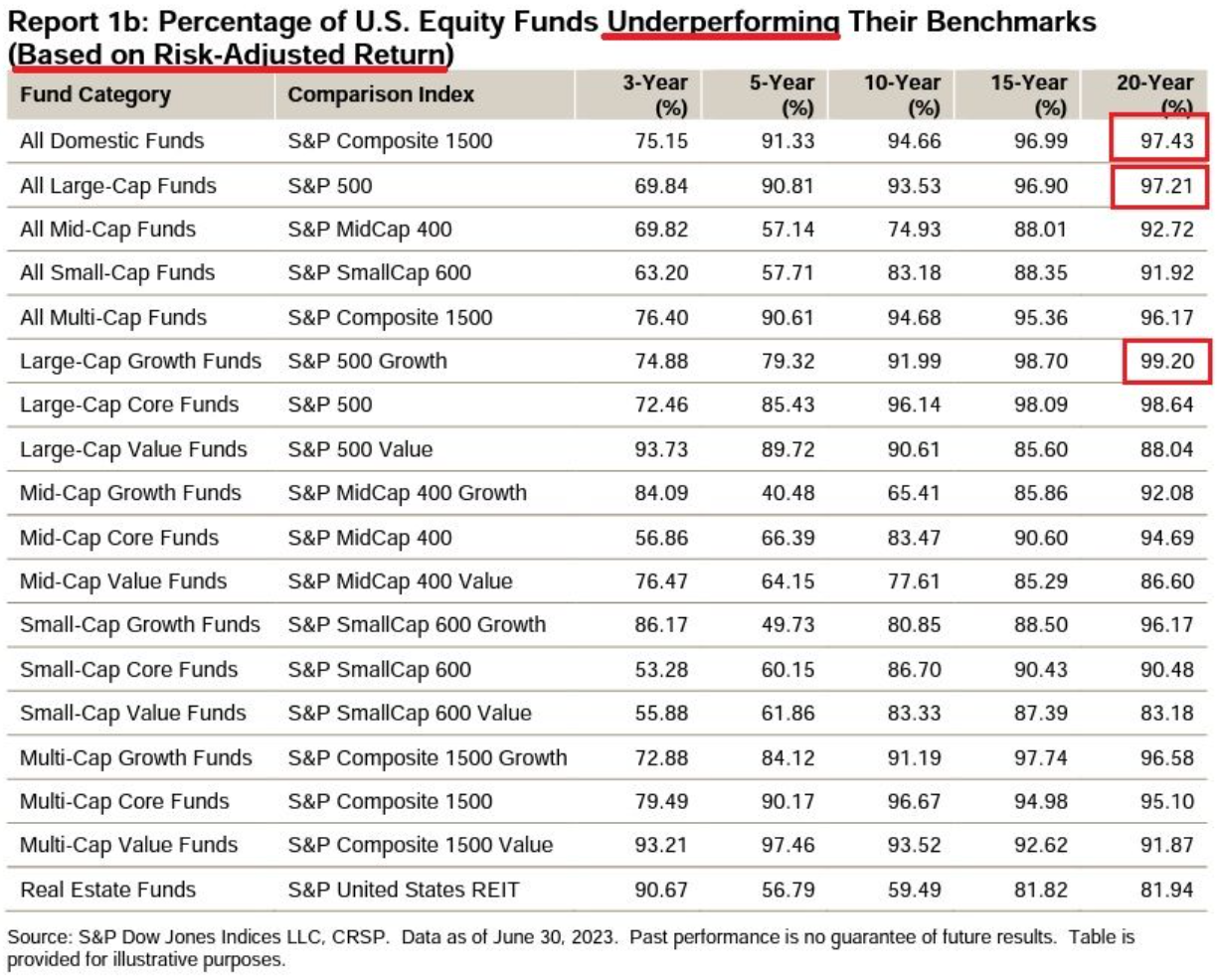

If we were to be completely honest, the mutual funds' mythical better results are sometimes a kind of lottery. According to Economic Times, in 2023, only half had higher returns than the index funds.

An analysis conducted by ETMutualFunds (to which the economic portal linked above refers) revealed that nearly half of the equity mutual fund schemes—around 50%—fell short in outperforming their benchmarks throughout 2023. With approximately 243 equity mutual fund schemes in the market, 122 of these schemes were unable to surpass their respective benchmarks during the same period.

Taking a closer look at the topic, it is clear that the the small cap and mid cap categories experienced the most significant impact, both encountering approximately 83% underperformance. Within the small cap segment, approximately 24 schemes existed in the market, with 20 of these schemes failing to surpass their respective benchmarks during the year. Similarly, within the mid cap category, approximately 29 schemes were available, among which 24 schemes did not exceed their respective benchmarks in 2023.

The above results are not an isolated case - over a longer time horizon, mutual funds do not gain at all in the eyes of investors. According to a recent SPIVA report, the "successes" of mutual funds are as follows:

Choosing Between ETFs and Mutual Funds: Factors to Consider

After familiarizing ourselves with the fundamentals and distinguishing characteristics of ETFs and mutual funds, it is important to examine the considerations that can guide one’s decision between these two investment options.

Diversification and Market Exposure

Investors utilize diversification as a key strategy in their investments to mitigate risk across various financial instruments and asset classes. While both ETFs and mutual funds offer this benefit, ETFs typically provide wider exposure at lower costs.

To diversify one’s portfolio, market exposure is another crucial aspect to consider when investing. This refers to the level of an investment’s involvement with a specific asset or sector. Through indexing, ETFs offer cost-effective market exposure by providing access not only to multiple stocks within a particular industry or country, but also broad market indexes.

Summary

There are both pros and cons to ETFs and mutual funds. Deciding between the two depends on various factors including your specific investment goals, risk tolerance level, tax implications, and preferred degree of involvement in managing your investments.

Investing in ETFs and mutual funds offers diversified exposure to a variety of assets within a single investment. ETFs trade on exchanges like stocks, making them easily accessible and providing liquidity. Meanwhile, mutual funds, managed by skilled fund managers from specific fund companies, offer the expertise of professionals in constructing and managing portfolios.

Both options have distinct advantages: ETFs tend to be more tax-efficient due to their structure, while mutual funds may offer active management strategies for those seeking potentially higher returns within a diversified portfolio. Choosing between them often depends on an investor's preferences for management style, cost structure, and tax implications.

It is important to remember that investing should be tailored to individual needs rather than a one-size-fits-all approach. Whether you opt for ETFs or mutual funds (or even a combination of both) or choosing stocks with Scrab 🙂, it’s crucial to have an understanding of what you’re investing in and why it aligns with your personal objectives.

Start your free trial

Start your 7-day free trial